Credit Card Fraud Prevention: Protect Your Business 💳🔐

What is Credit Card Fraud and How Can Businesses Prevent It? 💳🚨

Running a business means constantly navigating opportunities and risks, and one of the biggest challenges today is credit card fraud. Each swipe, tap, or click comes with the potential for fraud, which means businesses must stay alert to prevent substantial losses. In fact, billions are lost annually due to fraudulent activities. However, protecting your business doesn't need to be complicated. By understanding how fraudsters operate and employing the right practices, you can safeguard your operations effectively. It's similar to locking your store at night; when you know how thieves work and use the right tools, you can prevent fraud with ease.

Key Takeaways 📝

- Understand credit card fraud and the different types.

- Learn how fraud affects businesses and how to prevent it.

- Discover the steps for reporting credit card fraud.

- Debunk common myths about credit card fraud.

- Explore legal considerations and how AI tools help in fraud prevention.

What is Credit Card Fraud? 💳❌

Credit card fraud involves the unauthorized use of someone else's card information. Thieves gain access to card details through various means, such as online transactions or data breaches, and use them for fraudulent purchases. In some cases, fraudsters may even open new credit accounts in someone else's name. This type of fraud can severely damage a victim's credit score before they even realize it.

Credit card fraud is a widespread issue, with the Federal Trade Commission (FTC) reporting over $10 billion in losses to fraud in 2023 alone. Globally, the total loss reached approximately $33 billion.

Types of Credit Card Fraud 🚫

| Type | Description | Example |

|---|---|---|

| Card-Not-Present (CNP) Fraud | Fraudulent transactions conducted online or via phone without the card being physically present. | Fake orders on e-commerce websites using stolen card details. |

| Credit Card Skimming | Fraudsters install skimming devices on ATMs or Point-of-Sale terminals to steal card information. | Skimmers at gas stations capture card data. |

| Data Breaches | Cybercriminals breach systems to steal sensitive data. | Ransomware attacks holding customer data hostage. |

| Phishing Schemes | Fraudulent emails or messages trick individuals into revealing sensitive information. | Fake emails pretending to be from banks or merchants. |

How Credit Card Fraud Affects Businesses 🏢💔

The impact of credit card fraud on businesses is often immediate and severe. The most obvious consequence is financial loss. But beyond that, businesses face reputational damage and a loss of customer trust. Research shows that up to 60% of small businesses close within six months after a fraud attack. Once trust is lost, it's challenging to regain, and businesses may face higher security costs and compliance issues, which can ultimately drive them out of business.

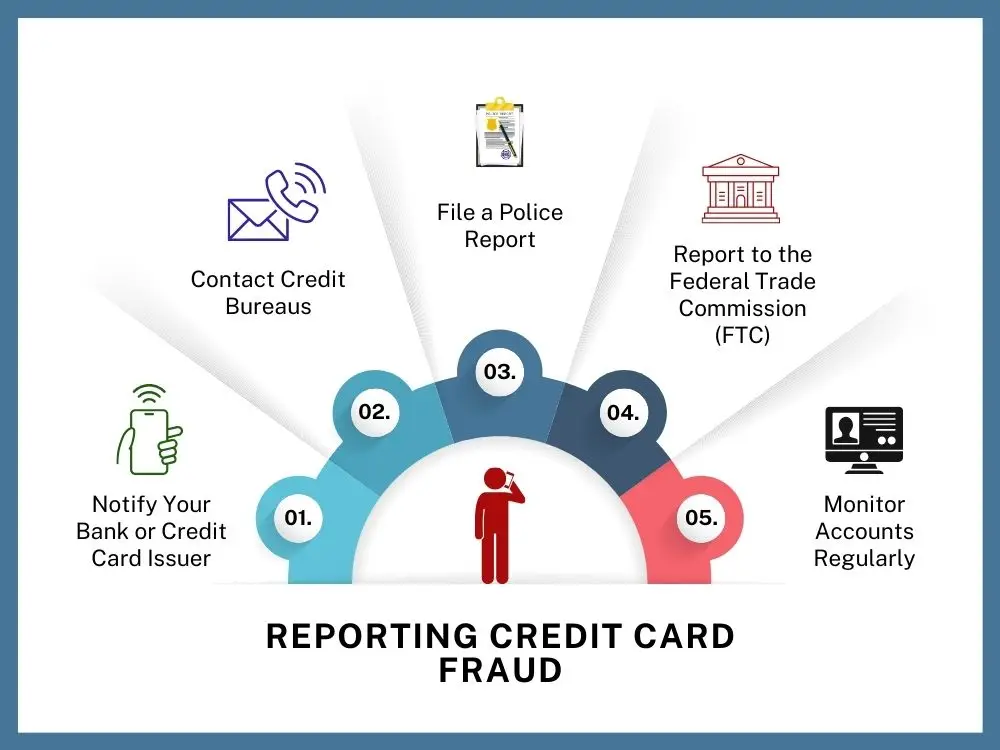

Reporting Credit Card Fraud 🛑

Prompt reporting is crucial when fraud occurs. Here's how to report credit card fraud effectively:

- Notify Your Bank or Card Issuer 🏦: Immediately report unauthorized charges.

- Contact Credit Bureaus 📊: Alert Experian, Equifax, and TransUnion to place a fraud alert on your credit.

- File a Police Report 🚔: This is optional, but it can help in investigations.

- Report to the FTC 💻: U.S. residents can file a complaint with the Federal Trade Commission.

- Monitor Accounts Regularly 🔍: Stay vigilant by checking your accounts regularly to catch any further suspicious activity.

Common Myths About Credit Card Fraud 💭

Here are some common myths and their realities:

| Myths | Reality |

|---|---|

| Fraudsters only target large businesses | Both large and small businesses are targets. In fact, 43% of attacks target small businesses. |

| Chip cards are the safest | Chip cards are vulnerable to Card-Not-Present fraud, where only the card details are needed. |

| Fraudulent transactions are easy to spot | Fraudulent transactions often resemble legitimate ones, making detection difficult without advanced tools. |

| Weak passwords aren’t a problem | Weak passwords are a common cause of fraud, as they allow easy access to systems. |

Effective Ways to Prevent Credit Card Fraud 🛡️

Here are several ways businesses can protect themselves from credit card fraud:

- Advanced Security Measures 🔐: Use encryption, multi-factor authentication, and ensure PCI DSS compliance.

- AI Fraud Detection Tools 🤖: Use AI-driven tools that monitor for unusual behavior and anomalies.

- Employee Training 📚: Regularly train employees to recognize phishing, malware, and other cybersecurity threats.

- Strengthen Customer Verification 👤: Use OTPs, biometrics, and address verification for sensitive transactions.

- Monitor Transactions 📉: Set limits on transaction amounts and track transactions in real-time to spot unusual activity.

Legal and Regulatory Considerations ⚖️

Businesses need to be aware of the following regulations:

- PCI DSS Compliance 🔒: This ensures proper encryption and secure systems for card transactions.

- GDPR and Data Protection 📜: European businesses must comply with GDPR, which governs the protection of customer data.

- CCPA 📍: California businesses must follow the CCPA, which protects personal data and privacy.

- Anti-Fraud Laws ⚖️: Laws like the US Computer Fraud and Abuse Act (CFAA) help prevent fraud and protect businesses.

How Smart Tools AI Helps in Credit Card Fraud Prevention 💡

AI tools are changing the way businesses fight credit card fraud. At Smart Tools AI, we offer tools to help businesses protect themselves:

- Credit Card Generator 🔄: Simulate transactions securely without using real customer data.

- Password Management Tools 🔑: Generate strong passwords to defend against data breaches.

- Fake Name and Address Generators 🏷️: Create fake customer profiles for testing without exposing real data.

Wrapping Up 🏁

Preventing credit card fraud is essential for any business. By understanding fraud types, using preventive measures, and leveraging AI tools, businesses can protect their operations, maintain customer trust, and stay secure in an ever-evolving digital landscape.

FAQs 🤔

Q1: What is the largest credit card fraud in history?

In 2013, a group in New Jersey stole $200 million using fake identities and credit profiles.

Q2: How can I detect credit card fraud?

Look for unusual spending patterns, multiple declined transactions, and mismatched billing info. Fraud detection tools can also be used.

Q3: What should I do if my business experiences a data breach?

Immediately shut down affected systems, notify banks and customers, and work with cybersecurity experts to investigate and resolve the issue.